Crowdfunding is a great way to get your start in business, and if you're not familiar with the platform, now is the time to learn! In this article, we'll take a look at Crowdestor, one of the most popular crowdfunding platforms out there. We'll discuss the features available on the platform, tell you how to use them, and give you a little bit of knowledge on how crowdfunding can help your cause.

Crowdestor is a crowdfunding platform that makes it easy for startups and small businesses to raise money from a large number of investors. You can also check here to read crowdestor review. The Crowdestor review highlighted how the platform makes it easy for startups and small businesses to find, connect with, and enlist the financial support of a large number of investors.

The Crowdestor system is also modular so that each startup or business can customize its approach to crowdfunding based on its unique needs. The Crowdestor review also praised the platform’s user interface, which is highly intuitive and easy to use. Finally, the review noted that Crowdestor offers a high level of security for both investors and startups alike thanks to its robust investor verification process.

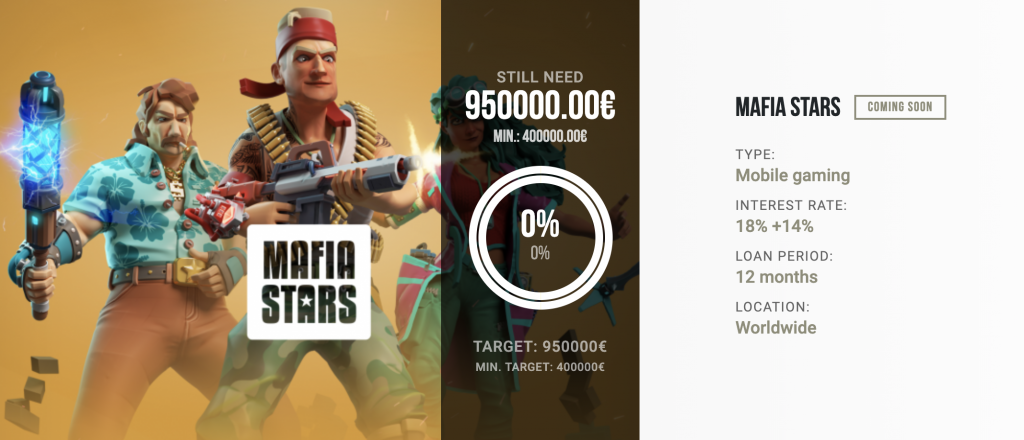

Crowdestor is one of the most popular crowdfunding platforms out there. It allows users to raise money for their projects through an easy-to-use interface. Once a project is created, Crowdestor makes it easy for investors to find and invest in it. Crowdstar also offers a wide range of features that make fundraising easier than ever before.